Key Figures

Figures based on 30 June 2022 / compared to 31 December 2021

* Figures based on 30 June 2022 / compared to 30 June 2021

Key financial figures

|

H1 22 |

H1 21 |

Property income |

32,428 |

30,644 |

Revaluation of properties |

42,291 |

32,238 |

– thereof yielding portfolio |

19,083 |

19,569 |

– thereof development portfolio |

22,632 |

1,860 |

– thereof transaction |

576 |

10,809 |

EBITDA |

62,354 |

52,944 |

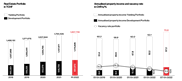

Net income |

56,102 |

41,946 |

Net income excl. revaluation of properties and deferred tax |

14,761 |

12,760 |

Cash flow from operating activities |

7,372 |

14,187 |

Cash flow from investment activities |

-27,551 |

-80,223 |

Cash flow from financing activities |

-27,915 |

72,672 |

in TCHF |

30/06/2022 |

31/12/2021 |

Cash and cash equivalents |

39,308 |

87,350 |

Shareholders’ equity |

1,018,700 |

988,999 |

Equity ratio |

52.4% |

52.0% |

Return on equity |

12.0% |

11.1% |

Average interest rate for financial liabilities |

0.79% |

0.78% |

LTV-Ratio gross |

42.4% |

44.5% |

LTV-Ratio net |

40.3% |

39.6% |

Balance sheet total |

1,942,978 |

1,903,643 |

Employee headcount |

77 |

77 |

– thereof real estate |

65 |

63 |

– thereof Pratteln site |

– |

3 |

– thereof Jaeger et Bosshard SA |

12 |

11 |

Key portfolio figures

in TCHF |

30/06/2022 |

31/12/2020 |

Investment property portfolio |

1,867,796 |

1,784,429 |

– thereof yielding portfolio |

1,175,826 |

1,137,671 |

– thereof development portfolio |

691,970 |

646,759 |

Gross yield yielding portfolio |

4.9% |

4.6% |

Net yield yielding portfolio |

3.8% |

3.6% |

Market value of investment properties |

1,833,176 |

1,752,318 |

Number of investment property portfolio |

114 |

114 |

– thereof yielding properties |

69 |

70 |

– thereof development properties |

45 |

44 |

Number of sites (yielding and development) |

45 |

44 |

Investments in investment property portfolio |

39,480 |

94,620 |

– thereof yielding portfolio |

7,011 |

25,956 |

– thereof development portfolio |

19,495 |

28,931 |

– thereof acquisitions (Asset Deal) |

12,974 |

39,733 |

Alternative Performance Figures

in TCHF except key figures per share |

H1 22 |

H1 21 |

Company specific earnings |

12,739 |

11,209 |

Company specific earnings per share in CHF |

1.26 |

1.35 |

Funds from operations |

14,954 |

12,429 |

Funds from operations per share in CHF |

1.48 |

1.49 |

in TCHF except key figures per share |

30/06/2022 |

31/12/2021 |

Adjusted NAV |

1,119,845 |

1,083,632 |

Adjusted NAV per share in CHF |

110.94 |

107.44 |

Key figures per share

in CHF |

H1 22 |

H1 21 |

Number of outstanding registred shares |

10,093,826 |

8,395,646 |

Number of weighted outstanding registred shares |

10,088,453 |

8,326,641 |

Earnings per share (EPS) |

10.25 |

9.01 |

EPS excl. Revaluation of properties and deferred tax |

3.87 |

5.01 |

in CHF |

30/06/2022 |

31/12/2021 |

Shareholders’ equity (NAV) per outstanding registered share, excl. deferred taxes |

109.10 |

106.10 |

Shareholders’ equity (NAV) per outstanding registered share, incl. deferred taxes |

100.92 |

98.06 |