Business performance

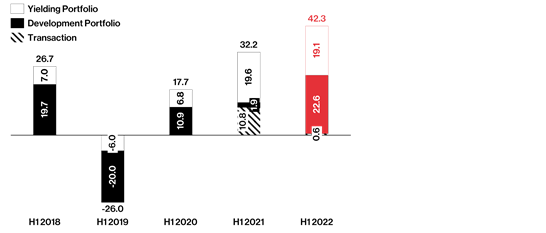

HIAG significantly increased its half-year profit 2022 by 33.7% to CHF 56.1 million (H1 2021: CHF 41.9 million). At CHF 42.3 million net (H1 2021: CHF 32.2 million), the revaluation gains from the prior-year period were far exceeded. Property income increased by 5.8% to CHF 32.4 million (H1 2021: CHF 30.6 million). At CHF 1.1 million, income from the sale of investment properties is slightly lower than in the same period of the previous year (H1 2021: CHF 1.7 million). In contrast, the first promotional sales for the new construction project "CHAMA Columbus" made a positive contribution to earnings of CHF 0.8 million before taxes (H1 2021: CHF 0). The successful refinancing of a CHF 150 million bond in May 2022 with a duration until October 2026 also ensures a healthy capital structure and supports future growth.

Financial performance

- At CHF 32.4 million, property income exceeded the previous year's figure by CHF 1.8 million (H1 2021: CHF 30.6 million). The pandemic no longer had a negative impact on the result (H1 2021: CHF 0.2 million). In addition, rental income has increased slightly as a result of index adjustments as of 1 June 2022.

- The vacancy rate for the overall portfolio was reduced significantly and amounted to 6.9% as at 1 July 2022 (01 January 2022: 10.7%). This positive development is mainly attributed to the completion of fully let construction projects as well as successful new and follow-up leases.

- Revaluation gains on investment properties increased substantially in the reporting year to CHF 42.3 million (H1 2021: CHF 32.2 million), mainly due to own management services and market-driven effects (e.g. reduction of market discount rates).

- Profit from the sale of investment properties amounted to CHF 1.1 million (H1 2021: CHF 1.7 million), which is down slightly on the previous year. In contrast, the first promotional sales for the new construction project "CHAMA Columbus" made a positive contribution to earnings of CHF 0.8 million before taxes (H1 2021: CHF 0).

- Other operating income of CHF 5.2 million is lower than in the same period of the previous year (H1 2021: CHF 6.8 million). The contribution to earnings of the metal recycling business Jaeger et Bosshard SA increased to CHF 4.8 million (H1 2021: CHF 4.3 million). However, this was not enough to compensate for the gains of CHF 1.9 million from the sale of a production equipment in Pratteln in the prior-year period.

HIAG's half-year profit 2022 significantly increased by 33.7% to CHF 56.1 million (H1 2021: CHF 41.9 million). Net profit before revaluation gains and deferred taxes amounted to CHF 14.8 million (H1 2021: CHF 12.8 million). This resulted in earnings per share (12 months rolling, based on the weighted average number of shares outstanding, including the additional shares outstanding from the November 2021 capital increase) of CHF 10.25 (H1 2021: CHF 9.01). Before revaluations and deferred taxes, this amounted to CHF 3.87 (H1 2021: CHF 5.01), a reduction caused by positive one-off effects from Pratteln (around CHF 1.2 million) in the prior-year period and the capital increase in November 2021.

EBITDA improved by CHF 9.4 million to CHF 62.4 million (H1 2021: CHF 52.9 million), while the figure before changes in value declined slightly to CHF 20.1 million (H1 2021: CHF 20.7 million). The main reason for the reduction is again the positive one-off effect from the sale of a production plant in Pratteln in the prior-year period.

Return on equity as at 30 June 2022 (12 months rolling) increased by 1.9 percentage points from 10.1% to 12.0% (based on weighted average equity) year-on-year.

in TCHF |

30/06/2022 |

30/06/2021 |

∆ in % |

Property income |

32,428 |

30,644 |

5.8% |

Revaluation of properties |

42,291 |

32,238 |

31.2% |

Income from sale of properties |

2,259 |

– |

– |

Profit from sale of properties |

1,086 |

1,661 |

-34.6% |

Other operating income |

5,202 |

6,827 |

-23.8% |

EBITDA |

62,354 |

52,944 |

17.8% |

EBIT excl. Revaluation of properties |

20,063 |

20,707 |

-3.1% |

Financial result |

-3,763 |

-5,615 |

-33.0% |

Taxes |

-2,161 |

-5,147 |

-58.0% |

Net income for the period |

56,102 |

41,946 |

33.7% |

Net income for the period excl. ravaluation of real estate and defferred taxes |

14,761 |

12,760 |

15.7% |

Yielding portfolio (leases)

At CHF 32.4 million (H1 2021: CHF 30.6 million), property income exceeded the previous year's figure by 5.8%. The pandemic had no negative impact on the result. Rental income could be increased as a result of index adjustments as of 1 June 2022 (status as of 30 June 2022: CHF 0.04 million).

Annualised property income increased by 12.2% to CHF 70.8 million (01 January 2022: CHF 63.1 million), primarily driven by new rentals (CHF 1.7 million), project completions (CHF 5.2 million) and index adjustments (CHF 0.4 million), and taking into account strategic transactions (purchases, sales) in which HIAG acquired annualised property income of CHF 0.5 million net.

The vacancy rate for the overall portfolio was strongly reduced and amounted to 6.9% as at 1 July 2022 (01 January 2022: 10.7%). The vacancy rate for the yielding portfolio amounted to 6.3% (01 January 2022: 9.6%).

The weighted average unexpired lease term (WAULT) rose to 8.5 years in the reporting period (prior-year period: 8.2 years). Applied to the 15 largest tenants, WAULT as at 1 July 2022 was as much as 10.8 years (01 January 2022: 10.2 years).

Development portfolio

Compared to the same period in the previous year, HIAG's development pipeline comprised a slightly reduced number of 61 projects with an expected total investment volume of CHF 3.07 billion (planned/estimated over the next 15 years). The related annual potential for rental income was around CHF 162 million, while the potential income from sales of promotion projects was around CHF 715 million.

During the reporting period, there were no property transfers between the existing and development portfolios.

The vacancy rate for the development portfolio dropped from 15.7% as at 1 January 2022 to 9.3% as at 1 July 2022. This is mainly due to additional rental income on existing development properties and selective new lettings.

Transaction business

In the reporting period, the following properties with a book value of CHF 0.7 million (H1 2021: CHF 2.0 million) were sold:

- Diesbach, Legler factory

- Diesbach, Hauptstrasse 38–40

At the same time, the following property with a book value of CHF 13.3 million (previous year: CHF 35.0 million) was acquired as part of an asset deal:

- Niederwil, Rigistrasse 1–5

Revaluation gains

Revaluation gains on investment properties increased considerably to CHF 42.3 million (H1 2021: CHF 32.2 million), taking into account provisions for environmental risks. This increase is attributed to own management efforts (including reduction of vacancies, rent extensions and rent increases as well as project progress at development properties) and market-related effects such as the reduction in discount rates and rent adjustments for indexed leases.

The average discount rate (net, real) applied by the independent property valuer to the total portfolio (excluding land, building rights and power plants) was 3.41% (31 December 2021: 3.54%).

Properties for sale (promotion) – earnings contribution and developments

As at 30 June 2022, the development pipeline included one property held for sale with a total of 52 residential units ("CHAMA Columbus" condominium) with ongoing investments of CHF 3.9 million (H1 2021: CHF 1.3 million). On 30 June 2022, the first two public deeds took place with a recognised revenue of CHF 2.3 million (H1 2021: 0). The resulting contribution to pre-tax earnings amounts to CHF 0.8 million (H1 2021: 0). The public deeds for a further 16 pre-reserved apartments are expected to be executed in the next few weeks.

Operating expenses

Operating expenses increased by CHF 2.5 million to CHF 20.9 million in the reporting period (H1 2021: CHF 18.4 million). This is mainly explained by the cost relating to the two promotional sales of CHF 1.4 million (H1 2021: 0), higher personnel cost due to additional employees and higher expected LTIP payments as a result of the good business performance. Expenses relating to the real estate business were stable at the previous year's level.

As at 30 June 2022, HIAG employed 77 people (H1 2021: 76). Personnel expenses amounted to CHF 7.9 million in the reporting period (H1 2021: CHF 7.0 million).

Operating and administrative expenses declined from CHF 3.7 million (H1 2021) to CHF 3.3 million.

Despite a better result, tax expenses fell to CHF 2.2 million (H1 2021: CHF 5.1 million) because of a reduction in the tax rate in the canton of Aargau.

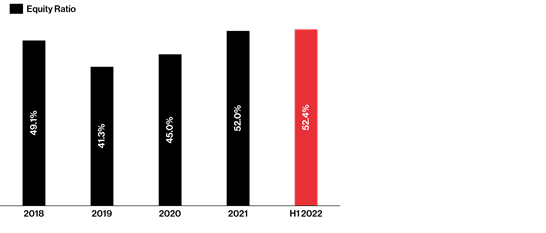

Financial position

- Total assets as at 30 June 2022 increased by 2.1% to CHF 1.94 billion

(31 December 2021: CHF 1.90 billion). - The equity ratio improved to 52.4% (31 December 2021: 52.0%).

The value of the investment property portfolio, the most important element of the balance sheet, increased by 4.7% to CHF 1.87 billion due to investments and revaluation gains and taking into account strategic transactions

(31 December 2021: CHF 1.78 billion).

in TCHF |

30/06/2022 |

31/12/2021 |

∆ in % |

Balance sheet total |

1,942,978 |

1,903,643 |

2.1% |

Sharholders' equity |

1,018,700 |

988,999 |

3.0% |

NAV per share, excl. deferred taxes in CHF |

109.10 |

106.10 |

2.8% |

NAV per share, incl. deferred taxes in CHF |

100.92 |

98.06 |

2.9% |

Real estate portfolio |

1,867,796 |

1,784,429 |

4.7% |

As at 30 June 2022, NAV increased by 2.8% to CHF 109.1 per share (31 December 2021: CHF 106.1 per share) or, taking deferred taxes into account, by 2.9% to CHF 100.9 per share (31 December 2021: CHF 98.1 per share).

With an equity ratio of 52.4% as at 30 June 2022 (31 December 2021: 50.0%), HIAG has a slightly stronger and extremely solid equity base.

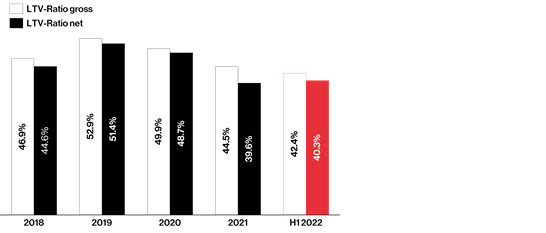

As at 30 June 2022, the loan-to-value (LTV) ratio gross fell to 42.4% (31 December 2021: 44.5%), the LTV ratio net increased slightly from 39.6% as at 31 December 2021 to 40.3%. This is due to the reduced level of cash and cash equivalents compared to 31 December 2021 following the dividend payment of CHF 27.2 million and the investments made in the amount of CHF 30.3 million.

Financial liabilities

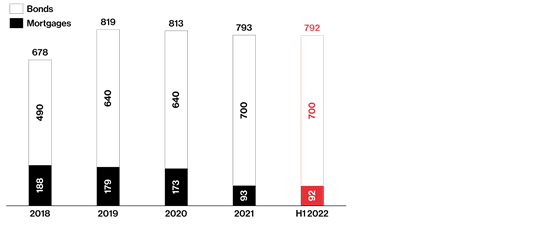

On 30 May 2022, a fixed-rate bond of CHF 150 million was successfully refinanced "one-to-one" with a new bond for CHF 150 million, a term of almost 4.5 years and a coupon of 1.77%.

As at 30 June 2022, financial liabilities consisted of listed bonds (CHF 700 million) and bank loans secured by mortgages (CHF 92 million). The average interest rate of 0.79% for financial liabilities only increased slightly during the reporting period (31 December 2021: 0.78%) as a result of the higher interest rate for the bond refinanced in May 2022. During the refinancing transaction, the average remaining term of the financial liabilities was extended to 2.8 years (31 December 2021: 2.5 years). The goal is to continue to extend the average remaining term in the future.

in TCHF |

30/06/2022 |

31/12/2021 |

∆ in % |

Total financial liabilities |

791,677 |

792,887 |

-0.2% |

Average remaining term of financial liabilities in years |

2.8 |

2.5 |

12.0% |

Average borrowing rate in % |

0.79% |

0.78% |

1.28% |

As of 30 June 2022, the bilateral framework credits totalled CHF 246 million, of which CHF 134 million was unused and freely available. A declared goal of HIAG is to increase these bilateral loans in the near future.

The long-term secured financing and solid equity base form the foundation of HIAG's successful development.

Investments

In line with its strategy, HIAG's investment activity is focused on the realisation of the project pipeline. As a result of project optimisations as well as construction cost increases, the pipeline was increased to a total investment volume of around CHF 2.75 billion (31 December 2021: CHF 2.70 billion) until 2031. In the reporting period, CHF 25.9 million was invested in the project pipeline.

Investments in the overall portfolio amounted to CHF 30.3 million in the first half of 2022 (H1 2021: 27.3 million).

Rico Müller

CFO